Why We Love The Porter's 5 Forces Analysis

Cheat Code To Get Quickly Familiar With An Unfamiliar Industry

Happy Thursday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Join Our CEO/Operator Network

Our Investment Criteria

Why We Love The Porter’s 5 Forces Analysis

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Join Our CEO/Operator Network

Atlasview Equity Partners is on the lookout for talented CEOs and experienced operators to drive growth at our portfolio companies. We are seeking professionals with an impressive track record and an abundance of ambition. If you're eager to leverage your leadership skills, build a lower-mid market business into a market leader, and generate significant personal wealth, we want to hear from you.

Interested in leading a PE-backed company?

By joining our exclusive list of top-tier candidates, you'll be the first to know about exciting CEO and operator opportunities within our expanding portfolio. We currently have an exciting pipeline of new opportunities, so join our network ASAP.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm acquiring and investing in software, business services, and other asset-light B2B businesses. For platform investments, we look for:

Business Model: software, business services, other asset-light

Business Size: minimum $2m EBITDA or $10m revenue

Business Profile: sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We’re actively seeking add-ons in the library, archive, legal, and government niches.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

Why We Love The Porter’s 5 Forces Analysis

At Atlasview, we are often presented with investment opportunities in industries that we may not be completely familiar with. Decisions need to be made quickly whether to pursue opportunities or not.

For that reason, we love utilizing Porter’s 5 Forces Analysis. It’s a high-level framework to obtain an understanding of a business’s competitive position within an industry. It assesses competitive threats from all major angles.

Here is a quick breakdown of how we approach each of the five forces:

Rivalry Among Existing Competitors

We want to know how powerful the competitors are. Some industries have a winner-take-all dynamic (often the case with horizontal software), and, unless we are looking at the winner, it's best to avoid.

Some Qs we might ask are:

Why isn't a competitor acquiring this business?

How much capital have competitors raised?

How fragmented is the market? Is there an active consolidator?

Threat of New Entrants

We want to know how difficult it is for a new upstart to launch and take market share. Large TAMs inevitably attract new entrants because the end prize is worth the pain of starting up. This is why we typically prefer niche end markets.

Some Qs we might ask are:

Is there interest from venture capitalists in this industry? Have there been newly funded upstarts?

How difficult/long is the sales process? Is distribution typically direct or indirect & gated?

How tailored is the product/service to the niche?

Bargaining Power of Suppliers

Suppliers for the types of businesses we look at are usually hosting providers, platforms, and labour. Platforms are ecosystems like Salesforce or Microsoft that the software (or service) could be built on top of. We want to know the strength of the partnership, and whether the business is at the complete mercy of the platform.

Some Qs we might ask are:

How much of a cut is the platform taking and when was the last time they increased it?

Could you serve your customers directly, without the platform? Could you partner with other competitive platforms?

Is there a specialized/skilled labour shortage in this industry?

Threat of Substitute Products

We want to know what the alternatives are to using the business's products and or services.

Some Qs we might ask are:

Is the product/service a need-to-have or nice-to-have? Is "non-use" an option for its customers?

Would it make sense for customers to in-source the product/service?

Bargaining Power of Buyers

We want a business that has many customers, as the more spread out the revenue is among them, the less power customers have over the business. Some businesses have indirect relationships with their customers via channel partners, so we need to understand what level of risk and influence the channel partner(s) pose.

Some Qs we might ask are:

How much revenue does the top 5 customers represent?

What are the switching costs and risks to customers?

When was the last time you increased your prices? What happened?

You can score each of the five forces out of 10 to get a (somewhat) objective measure of the opportunity at hand. But even just using this as a general guide will help you streamline your discovery process when presented with an industry that you're unfamiliar with.

In Case You Missed It

Here are some of our previous popular issues:

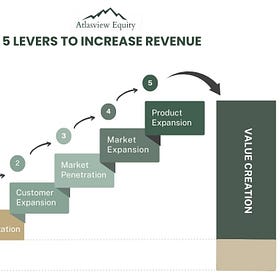

5 Value Creation Levers To Increase Revenue

As the saying goes, revenue cures all ails. The first value-creation opportunity Atlasview looks for in a business is organic revenue growth. There are often low-hanging fruits to increase the top line without needing to invest additional capital.

This post covers our 5 favouriate value-creation levers.

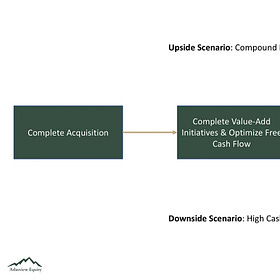

Our Approach To Upside vs Downside

At Atlasview, for each deal we look at, we map out what the probable downside and upside scenarios look like. We want there to be an element of positive asymmetry between the upside case and the downside case.

This post summarizes our approach.

The Lindy Effect

At Atlasview, we are big believers in The Lindy Effect. Popularized by author, Nassim Taleb, it states that the longer something has been around, the longer it will likely continue to be around. We consider this when looking at businesses to acquire or invest in.

Businesses with longevity often come with a high degree of resilience.

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Us

Atlasview Equity Partners is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. We combine patient capital with proven strategies to deliver predictable results for our stakeholders.