Why We Love Vertical Niche Businesses

Higher Profit Margins, Higher Barriers to Entry, Higher Returns on Capital

Happy Friday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Our Investment Criteria

Why We Love Vertical Niche Businesses

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm acquiring and investing in software, business services, and other asset-light B2B businesses. For platform investments, we look for:

Business Model: software, business services, other asset-light

Business Size: minimum $2m EBITDA or $10m revenue

Business Profile: sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We’re actively seeking add-ons in the library, legal, and government niches.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

Why We Love Vertical Niche Businesses

At Atlasview, we are huge fans of vertical niche businesses. These are businesses that sell software, services, or products to a single vertical only (such as law firms, credit unions, or physiotherapy clinics).

We believe that an intangible asset forms in a business when all of its customers look identical. We will always favor strategies to gain vertical depth instead of horizontal breadth. After making a platform investment into a vertical, Atlasview looks to expand along the value chain to gain depth within the vertical. We achieve this through both organic expansion and M&A.

Here are some of the benefits a business gains when it picks 1 vertical and goes all in:

1) Increased pricing – vertical specialists can charge more for their products since they should be more tailored to the specific needs of customers within that vertical (more on this in the 3rd point).

2) Cost efficiencies – instead of spreading the sale/marketing dollars thin across a bunch of verticals, you can concentrate them. All of the marketing can be tailored to a single vertical, reaching targets more effectively and driving a much higher conversion rate. This will result in more efficient spend and higher ROI.

3) Enhanced products – you can develop your products in a way that solves problems unique to customers within that vertical. This will make your R&D spend more efficient because you know exactly what you are building and for whom. Products become more tailored to your customers, making competing alternatives unattractive and switch costs high.

4) Barriers to entry – by focusing on a single vertical, the business will gain a “knowledge edge”. The business will know the vertical and understand its customers better than outsiders would – and vice versa, customers would all know and trust the business well. This makes it hard for new entrants to enter the vertical and replicate this.

Combine all this and the result is a business that generates higher profit margins, higher return on invested capital, and is harder to disrupt. Under the right circumstances, vertical specialization can result in a mini-monopoly or at least a dominant market share.

In Case You Missed It

Here are some of our previous popular issues:

4 Non-Financial Reasons Owners Sell

As a buyer of owner-operator businesses, Atlasview has encountered all kinds of reasons why owners look to sell their businesses. Here are 4 common non-financial reasons owners look to sell their perfectly healthy business:

Reinvesting Capital in Organic Growth

Capital allocation is a critical part of generating outside returns. Here is how we approach reinvesting capital into organic growth initiatives.

Our Approach To Upside vs Downside

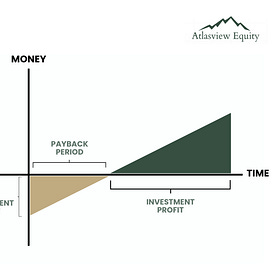

At Atlasview, for each deal we look at, we map out what the probable downside and upside scenarios look like. We want there to be an element of positive asymmetry between the upside case and the downside case.

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Us

Atlasview Equity Partners is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. We combine patient capital with proven strategies to deliver predictable results for our stakeholders.