Our Approach To Upside vs Downside

Opportunities Where We Can Both Protect & Compound Capital

Happy Wednesday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Our Investment Criteria

How We Approach Upside vs Downside

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. We are actively looking for businesses with the following characteristics:

Business Model: Software, services, asset-light B2B

Business Size: Minimum $1m EBITDA or $5m ARR

Business Profile: Sticky B2B customer base

Business HQ: US & Canada

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

How We Approach Upside vs Downside

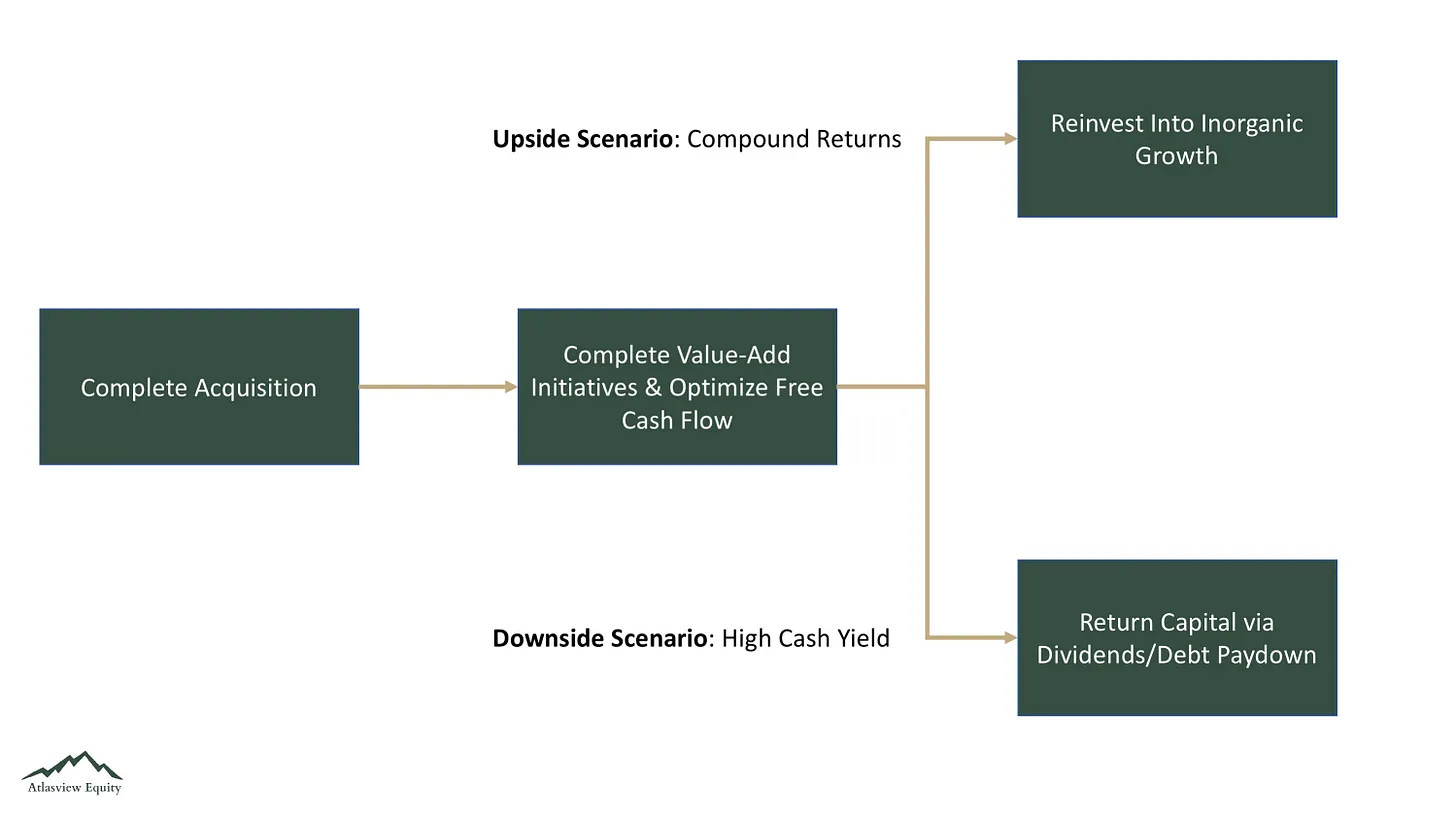

At Atlasview, for each deal we look at, we map out what the probable downside and upside scenarios look like. We want there to be an element of positive asymmetry between the upside case and the downside case.

This diagram summarizes our approach:

Downside Scenario - Return Capital

We always start with the downside scenario. We always want a good margin of safety and protect our downside above all. We love businesses that have stability in free cash flow and there are a few key ingredients we look for to evidence this:

Pricing power

Recurring revenue

High gross margins

Stable operating expenses

Relatively low capital expenditures

Our goal in the downside scenario is to return invested capital (both debt & equity) via internal cash flows. Stability in cash flows is one side of that equation, but the other side is purchase price. The purchase price needs to be at a level where capital return via internal cash flows creates an attractive yield. If the purchase price is too high, the yield would be too low for us to justify the risk and cost of capital.

Upside Scenario - Reinvest Capital

For our upside scenario, unless there is a compelling organic case to be made, we tend to favour inorganic growth (M&A). It’s typically a more predictable way to build a bigger business in a reasonable time frame. For this reason, we look for industries that are fragmented and have a supply/demand imbalance.

Side note: are you a business owner operating in a fragmented industry? Interested in working with Atlasview to consolidate it? Reach out to us today!

Our goal in the upside case is to reinvest capital (and even increase the invested capital) to make add-on acquisitions. A strong platform enables us to compound capital at an attractive rate of return and generate a sizeable multiple on invested capital.

In Case You Missed It

Here are some of our previous popular issues:

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast. We are proud to say that we have a 100% close rate on our signed LOIs.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Us

Atlasview Equity is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. We combine patient capital with proven strategies to deliver predictable results for stakeholders.