Happy Wednesday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Our Investment Criteria

5 Value Creation Levers To Increase Revenue

Book Recommendation - Winning Moves by Dan Cremons

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm acquiring and investing in software, business services, and other asset-light B2B businesses. For platform investments, we look for:

Business Model: software, business services, other asset-light

Business Size: minimum $2m EBITDA or $10m revenue

Business Profile: sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We’re actively seeking add-ons in the library, archive, legal, and government niches.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

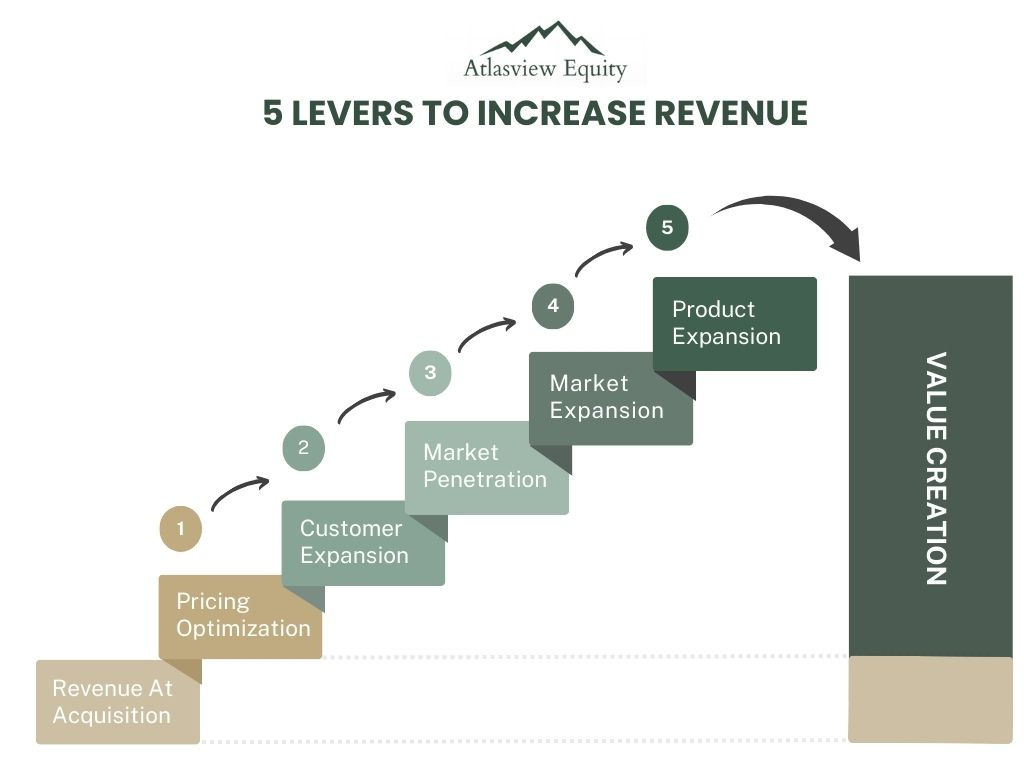

5 Value Creation Levers To Increase Revenue

As the saying goes, revenue cures all ails. The first value-creation opportunity Atlasview looks for in a business is organic revenue growth. There are often low-hanging fruits to increase the top line without needing to invest additional capital.

Here are the 5 value-creation levers, in order of priority for us:

1) Pricing Optimization

We love businesses that have a high degree of pricing power. Increasing prices is a surefire way to grow revenue, improve margins, profitability, cash flow, and create value.

Beyond simply increasing prices, we often find opportunities to change the pricing logic to better match the value customers get from the product. This might mean tying pricing to usage, cost or time saving, revenue generated, or adding additional fees for various extras.

2) Customer Expansion

Sell existing products to existing customers. It’s always easier to sell to your existing customers. Businesses often have a portfolio of products, but most of their customers use only one or two products. Getting customers to purchase multiple different types of products from you, aka cross-selling, is a fantastic way to increase the share of wallet and the stickiness of customers.

Another form of customer expansion is to get your customers to buy more (or better quality) of what they are already paying for, aka the upsell. Whether it is buying more volume, usage, or a higher tier of product/service, all are ways to increase customer contract value.

3) Market Penetration

Acquire new customers in an existing vertical. We love businesses that focus on a single vertical for many reasons - one of the main reasons is that customer acquisition is far more efficient. If the business has a long history of excellence within a single vertical, this should result in a high sales/marketing ROI.

We look for opportunities to revamp go-to-market initiatives to generate new leads. Initiatives may include cold outbound, search engine optimization, email marketing, and paid advertising.

4) Market Expansion

Expand into new customer verticals. Perhaps there are adjacent verticals that would find significant value in the business’s products. This might make logical sense if a business has already maxed out on its core vertical (where the 3rd point above may not yield any results).

This could also entail geographical expansion. Perhaps there is less competition overseas or in another region, which may result in a great ROI.

5) Product Expansion

Develop new products to offer both existing and new customers. This lever comes with the greatest risk as capital investment is required to develop new products. Not to mention the added risk of uncertainty on whether these new products will sell.

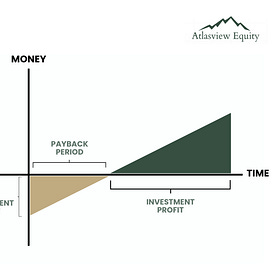

In these scenarios, we look for a level of pre-commitment from existing customers for new product development. As we outline in our approach to organic reinvestment, we want a clear and measurable payback period.

Book Recommendations - Winning Moves by Dan Cremons

These revenue levers were taken from Dan Cremon’s book called Winning Moves. We are a huge fan of this book and the strategies outlined in it, it’s a mandatory reading for all private equity investors.

In Case You Missed It

Here are some of our previous popular issues:

Why We Love Vertical Niche Businesses

At Atlasview, we are huge fans of vertical niche businesses. These are businesses that sell software, services, or products to a single vertical only (such as law firms, credit unions, or physiotherapy clinics).

Here are a few reasons why:

4 Non-Financial Reasons Owners Sell

As a buyer of owner-operator businesses, Atlasview has encountered all kinds of reasons why owners look to sell their businesses. Sometimes it’s financially driven - business owners are looking for a well-deserved payday and want to diversify their net worth. But sometimes, the reason for the sale has little to do with money.

Here are 4 common non-financial reasons owners look to sell their perfectly healthy businesses:

Reinvesting Capital in Organic Growth

At Atlasview we generally prefer reinvesting free cash flow/capital into inorganic growth (M&A, add-on acquisitions), as outlined in our upside case. But sometimes we uncover opportunities for substantial reinvestment into organic growth as well. For the types of companies we specialize in, organic reinvestment generally falls under two broad categories:

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Us

Atlasview Equity Partners is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. We combine patient capital with proven strategies to deliver predictable results for our stakeholders.