Happy New Year Folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Have An Opportunity For Us?

Generating Compound Returns

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm that acquires and builds B2B businesses in the lower middle market. For platform investments, we look for:

Business Model: vertical software, business services, specialty distributors

Business Size: minimum $2m EBITDA or $10m revenue

Business Profile: sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We’re seeking add-ons in the library, archive, legal, and government niches for our portco Soutron Global and HVAC distributors for our portco PureFilters.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

Generating Compound Returns

To generate compound returns over the long term, a business requires two key components: 1) free cash flow and 2) reinvestment opportunities. At Atlasview, when evaluating a potential platform investment, we prioritize ensuring that both components are present.

Let’s explore each in more detail.

1. Free Cash Flow

Stable and predictable free cash flow de-risks the investment and unshackles the business from being at the mercy of capital markets. It also creates capital allocation optionality to pay out a dividend, pay down debt, or allocate to reinvestment opportunities.

At Atlasview, we prioritize businesses with a long operating history and a proven track record of free cash flow generation. Additionally, we assess whether the cash flow is well-protected against internal and external threats. One of our preferred tools for evaluating these threats is Porter’s Five Forces, discussed in more detail in this post:

Post-acquisition, Atlasview partners closely with management to implement value-add initiatives that enhance free cash flow. Our playbook focuses on driving revenue growth, improving margins, and optimizing working capital. We discuss some of these initiatives in this post:

Of the two components required for compound returns, free cash flow is non-negotiable. Without stable free cash flow, reinvestment opportunities become irrelevant. Once a business meets this critical criterion, we shift our focus to reinvesting that cash flow.

2. Reinvestment Opportunities

Reinvestment opportunities are what allow a business to achieve significant long-term growth. At Atlasview, we favor businesses with clear and compelling reinvestment opportunities and are eager to make follow-on investments post-acquisition to capitalize on them.

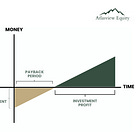

In terms of reinvestment into organic growth, it typically focuses on sales/marketing and research/development. We look for initiatives with a clear return on investment (ROI) and a payback period of 12 months or less. We discuss payback period in more detail in this post:

In terms of reinvestment into inorganic growth, Atlasview works closely with management teams to source and execute add-on acquisitions. Growing through M&A is an excellent way to scale a business quickly. Reinvestment via acquisitions can help businesses:

Acquire new customers or revenue streams

Expand into new geographies

Add synergistic product lines

Bring in top-tier talent

The ultimate goal of reinvestment is to transform businesses into market leaders and deliver outsized returns to shareholders, which often include the management teams we partner with.

In Case You Missed It

Here are some of our previous popular issues:

Atlasview-Backed Soutron Global Acquires MINISIS

Atlasview Equity Partners (“Atlasview”) portfolio company, Soutron Global (“Soutron”) has acquired MINISIS Inc. (“MINISIS”). MINISIS, founded over 40 years ago, is a Canadian-based software provider for museums, archives, and libraries globally. This acquisition furthers Soutron’s presence in Canada and strengthens its product offering. Atlasview contin…

Adjusted EBITDA 101

Adjusted EBITDA is a commonly used measure of performance for businesses of all sizes and a basis for valuation. There are no clear-cut rules or accounting standards for reported Adjusted EBITDA. As a result, the metric is highly subjective and can be a wide range of numbers, depending on who you ask. So let’s take a closer look at Adjusted EBITDA.

Capital Cycle Theory

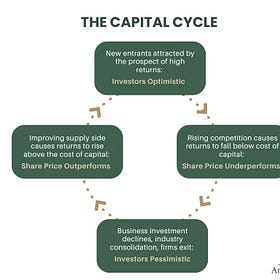

Popularized by Marathon Asset Management via the book Capital Returns, Capital Cycle Theory dictates that investor returns are largely impacted by the capital flowing in or out of industries. Being on the right side of capital flows can generate sizeable returns. And being on the wrong side of capital flows can absolutely destroy your returns.

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Atlasview

Atlasview Equity Partners is a founder-first private equity firm specializing in acquiring and building businesses in the lower middle market. Atlasview seeks businesses with defensible moats and multiple levers to add significant value to create an asymmetric returns profile. Atlasview works closely with management teams to execute organic and inorganic (M&A) growth initiatives to build businesses into market leaders.