Adjusted EBITDA 101

Best Practices For Buyers and Sellers

Happy Friday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Interested in Leading a PE-Backed Company?

Have An Opportunity For Us?

Adjusted EBITDA 101

Recommended Read: The Case For Small Buyouts

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Interested in Leading a PE-Backed Company?

Atlasview Equity Partners is on the lookout for talented CEOs and experienced operators to drive growth at our portfolio companies. We are seeking professionals with an impressive track record and an abundance of ambition. If you're eager to leverage your leadership skills, build a lower-mid market business into a market leader, and generate significant personal wealth, we want to hear from you.

Join Atlasview’s CEO/Operator Network

By joining our exclusive list of top-tier candidates, you'll be the first to know about exciting CEO and operator opportunities within our expanding portfolio. We currently have an exciting pipeline of new opportunities, so join our network ASAP.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm that acquires and builds B2B businesses in the lower middle market. For platform investments, we look for:

Business Model: vertical software, business services, specialty distributors

Business Size: minimum $2m EBITDA or $10m revenue

Business Profile: sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We’re seeking add-ons in the library, archive, legal, and government niches for our portco Soutron Global and HVAC distributors for our portco PureFilters.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

Adjusted EBITDA 101

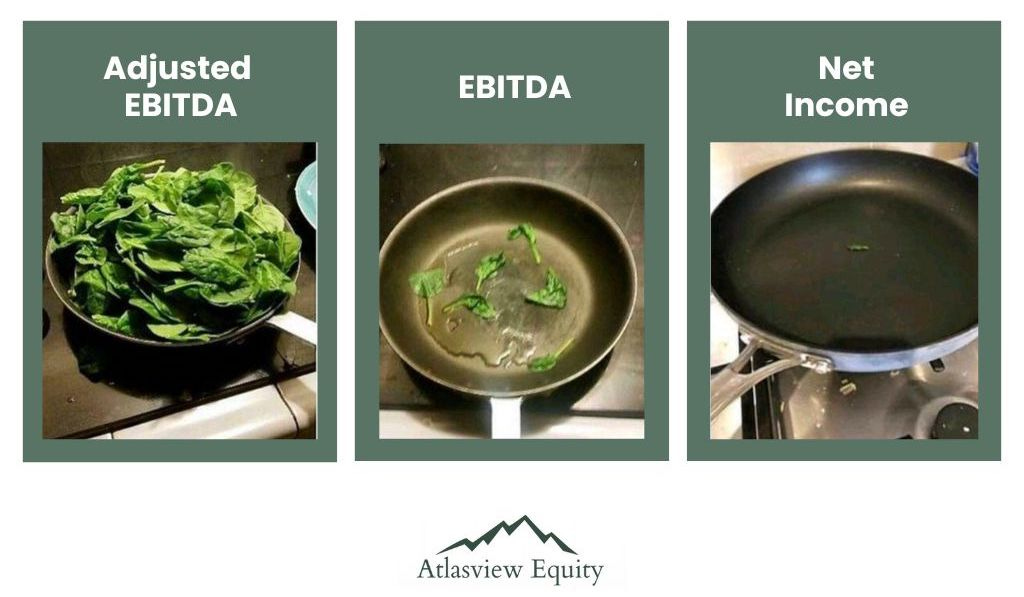

Adjusted EBITDA is a commonly used measure of performance for businesses of all sizes and a basis for valuation. There are no clear-cut rules or accounting standards for reported Adjusted EBITDA. As a result, the metric is highly subjective and can be a wide range of numbers, depending on who you ask. So let’s take a closer look at Adjusted EBITDA.

Adjusted EBITDA Refresher

EBITDA (earnings before interest, taxes, amortization, and depreciation) is a short-cut metric for measuring how much cash earnings a business generates annually. Yet, making those 4 adjustments often isn’t enough to arrive at a business’s economic profits. There often needs to be further adjustments for expenses and or revenues accounted for in EBITDA that are not considered to be “core” or essential to operating the business.

Here are some examples of common EBITDA adjustments:

One-off events – lawsuits, natural disasters, or anything else that is a one-time event. The adjustment could be to remove the expense from EBITDA.

Overpaid or underpaid employees – businesses can over or undercompensate employees. The adjustment here would be to use market-rate salaries for key employment positions.

Personal expenses – many businesses, especially smaller ones, will have the owner’s personal expenses reflected on the P&L. Adding back items such as meals & entertainment, travel, home office, and automobile expenses might make sense. In smaller transactions, it’s common for the owner’s salary to also be added back to EBITDA in full to arrive at “seller discretionary earnings” or SDE.

Other streams of revenue – businesses that have other streams of revenue that aren’t connected to the core business, consider subtracting it from EBITDA.

Intercompany transactions – businesses that have multiple entities could have intercompany revenue and expenses that aren’t true economic activity. These should be adjusted for accordingly.

Buyer Best Practices

It’s important to understand what is an acceptable adjustment as a seller (or their advisor) will be incentivized to include as many as possible to improve their EBITDA. As a buyer it is critical to ask yourself “Is this really non-core and or non-reoccurring to the operating business I am buying?” and “Will I not experience the proposed adjusted revenue/expenses under my ownership?”.

Seller Best Practices

As a seller, you know the business better than anyone else so you should know what adjustments make the most sense. Also, keep in mind, that most buyers will perform a quality of earnings analysis (QofE), so you’ll want to ask yourself “Will these adjustments pass scrutiny from a 3rd party QofE provider?”. Being transparent and candid about adjustments upfront is beneficial for all parties involved in the transaction.

If you have any questions about EBITDA adjustments for your business, always feel free to reach out to us. Our team has access to some great resources for anyone who is looking to navigate this metric.

Recommended Read: The Case For Small Buyouts

RCP Advisors published a nice research piece called The Case For Small Buyouts. It’s a great case study on lower-middle market investing and its structural advantages. The team at Atlasview enjoyed the case study, and highly recommend it to all private equity investors.

In Case You Missed It

Here are some of our previous popular issues:

4 Non-Financial Reasons Owners Sell

Atlasview has encountered all kinds of reasons why owners look to sell their businesses. Sometimes it’s financially driven - business owners are looking for a well-deserved payday and want to diversify their net worth. But sometimes, the reason for the sale has little to do with money.

Atlasview Completes Sale of Viostream to Banyan Software

Toronto, ON - Atlasview Equity Partners (“Atlasview”) has successfully realized its investment in Viostream through a sale to Banyan Software. Banyan is a leading acquirer of great enterprise software businesses globally.

Why We Love The Porter's 5 Forces Analysis

At Atlasview, we are often presented with investment opportunities in industries that we may not be completely familiar with. Decisions need to be made quickly whether to pursue opportunities or not. For that reason, we love utilizing Porter’s 5 Forces Analysis.

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Atlasview

Atlasview Equity Partners is a private equity firm that acquires and builds B2B businesses in the lower middle market. We combine patient capital with proven strategies to deliver predictable results for our stakeholders.