The Atlasview Approach to Value Creation

Atlasview Insights -- bite-sized weekly insights that are relevant to all business owners, dealmakers, and investors.

Happy Wednesday Folks!

Thanks for joining us for another week of Atlasview Insights. If you’re a new reader, welcome! Every other week we share industry insights and thought leadership on all things software and investing.

This week we’re covering the following topics:

The Atlasview approach to value creation

One of our team’s favorite business reads from 2022

Perspectives from industry operators and investors

Atlasview Perspectives: How to Deliver Outsized Returns

There are 2 key ingredients that a business requires in order to generate compound returns over the long run:

Free cash flow

Reinvestment opportunities

We want to dissect each component individually and explain how our team approaches value creation post-acquisition.

1. Free Cash Flow

A high level of predictable free cash flow (relative to the equity invested) de-risks the investment and unshackles the business from being at the mercy of capital markets. It also creates the optionality to pay out a dividend, pay down debt, or allocate to reinvestment opportunities.

Not only is a business’s free cash flow fairly easy to assess as an investor, but it’s also predictably optimized as an experienced operator (by executing proven strategies).

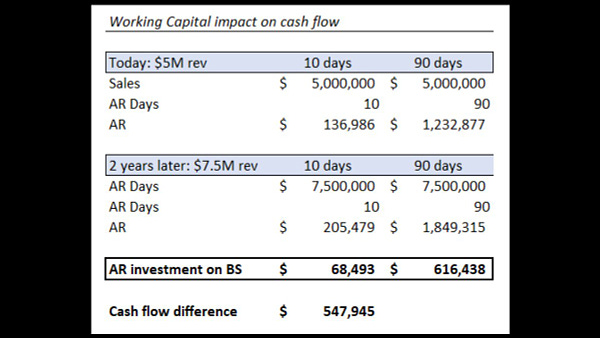

The implementation of our value-add strategies leads to a surplus of free cash flow that is generated from the business within a couple of years of ownership.

How Atlasview Approaches Free Cash Flow:

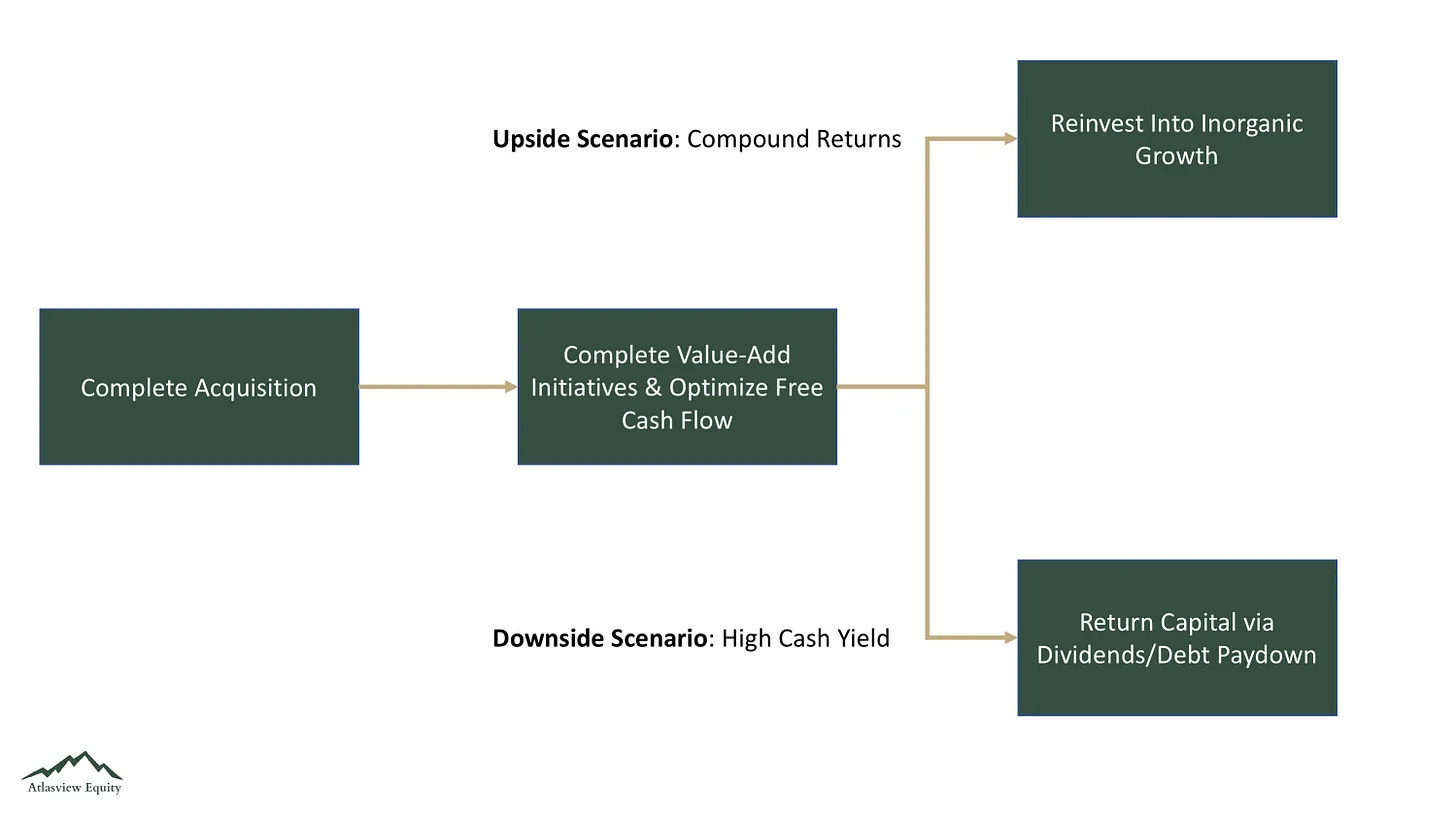

Of the 2 components, ample free cash flow is the one that is absolutely mandatory for the businesses Atlasview targets. We underwrite our investment so that the cash surplus alone will drive a sufficient enough ROI. Atlasview aims to fully return capital via dividends as a downside case, resulting in a high cash dividend yield. This is unless we discover attractive reinvestment opportunities.

2. Reinvestment Opportunities

Reinvestment opportunities within a business or industry are far more difficult to assess at acquisition. As a buyer of a private business, there will always be information asymmetry working against you.

Business owners have often already tried many organic growth initiatives. The nature of the high-switching cost moat that niche-vertical software/technology businesses enjoy, their competitors enjoy as well. This often makes organic growth a low-ROI endeavor, as it’s very costly to get customers to switch to your software/technology. Not to mention, these niche markets are typically mature and over the software adoption curve, resulting in modest demand growth.

However, it’s rare that a business owner has attempted inorganic growth because it’s time-consuming, deemed relatively risky, and requires a specialized skillset (M&A).

How Atlasview Approaches Inorganic Growth:

Within 6-12 months of ownership, we expand our knowledge of the business, the industry, and its niche. With this informational edge, we know if increasing our bet size would make sense. And if it did make sense, we allocate the surplus cash to inorganic growth instead of returning capital.

We work closely with management to execute and integrate add-on acquisitions. Given our team’s experience/expertise in leading deals, this should be an area where we would add significant value.

Create Cash Flow to Create Optionality

Our value-add strategies are designed to create excess free cash flow, which in turn creates optionality. The goal is to find attractive reinvestment opportunities (add-on acquisitions) to compound capital and generate outsized returns. But in the case that we don’t find anything, our businesses should be able to return capital back to investors in a manner that still delivers an attractive return.

On that note, if you are a business owner, deal intermediary, or advisor with a company that could be of interest for a transaction, feel free to reach out. Atlasview has ample dry capital and LP relationships excited to invest alongside us!

Here’s a quick overview of our investment criteria:

Our Investment Criteria

We look for the following characteristics in our partner companies:

Industry: Software and tech-enabled businesses

Business Profile: Sticky B2B customer base

Size: Minimum $1m EBITDA or $5m ARR

Geography: The US & Canada

Favorite Business Read from 2022

Pick – Junk To Gold by Willis Johnson

The book is about the story of Copart, written by the founder of the company. Copart sources wrecked cars from insurance companies, stores them in their junkyards, and then sells them via their online auction.

Why did we like it?

It’s an inspiring story, Willis started the business by acquiring his first junkyard for $75k. Through shrewd acquisitions, creative financing, and operational innovations – Copart has grown into a $30bn behemoth. What’s fascinating about Copart is that it is one of the rare businesses that has both a digital moat and a physical moat. Not to mention, it is perhaps one of the best roll-ups of all time.

Our team wrote about the art of rollups in last week’s newsletter:

Operator Perspectives

Deal Maker Perspectives

We have a ton of content lined up for small business owners, deal makers, and investors. Lots of valuable topics including:

Buying businesses

Optimizing cash flow for your business

Preparing your business for an exit

Inner workings of an emerging private equity firm

Scaling customer acquisition

Deal sourcing and structuring

Software and technology investing

If you come across any interesting articles or want us to cover a specific topic in an upcoming newsletter, reply to this thread!