Atlasview Selected In Axial's 2023 Software Top 50 List

Atlasview Insights -- bite-sized weekly insights that are relevant to all business owners, dealmakers, and investors.

Happy Wednesday folks!

Thanks for joining us for another edition of Atlasview Insights. We’re back with another week of sharing bite-sized insights that are relevant to small business owners, dealmakers, and investors.

If you are not familiar with Atlasview Equity, we are a private equity firm specializing in software and tech-enabled businesses. You can learn more about our team and investment criteria: here.

In this newsletter, we cover:

Atlasview’s feature on Axial’s 2023 Software Top 50 Dealmaker List

Maintainable free cash flow breakdown

Our favorite reads from fellow deal makers and operators

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Let’s Get In Touch

We look for the following characteristics in our partner companies:

Industry: Software and tech-enabled businesses

Business Profile: Sticky B2B customer base

Size: Minimum $1m EBITDA or $5m ARR

Geography: The US & Canada

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to reach out and get in touch with us!

Axial's 2023 Software Top 50 Dealmaker List

We are honored to be included in Axial's 2023 Software Top 50 List!

Ryan Khan (Principal, Atlasview Equity) had the chance to share some valuable insights about the current software market, valuations, and the outlook for dealmakers:

Software businesses are facing somewhat of an industrial revolution. The cost of capital has increased and is now forcing businesses to keep a close eye on the bottom line. This means becoming leaner and more efficient. In this new economic climate, companies are going to look closely at their core business model and start to reevaluate non-core assets due to capital allocation decisions.

Continue reading the full article here.

Atlasview Perspectives: Maintainable Free Cash Flow

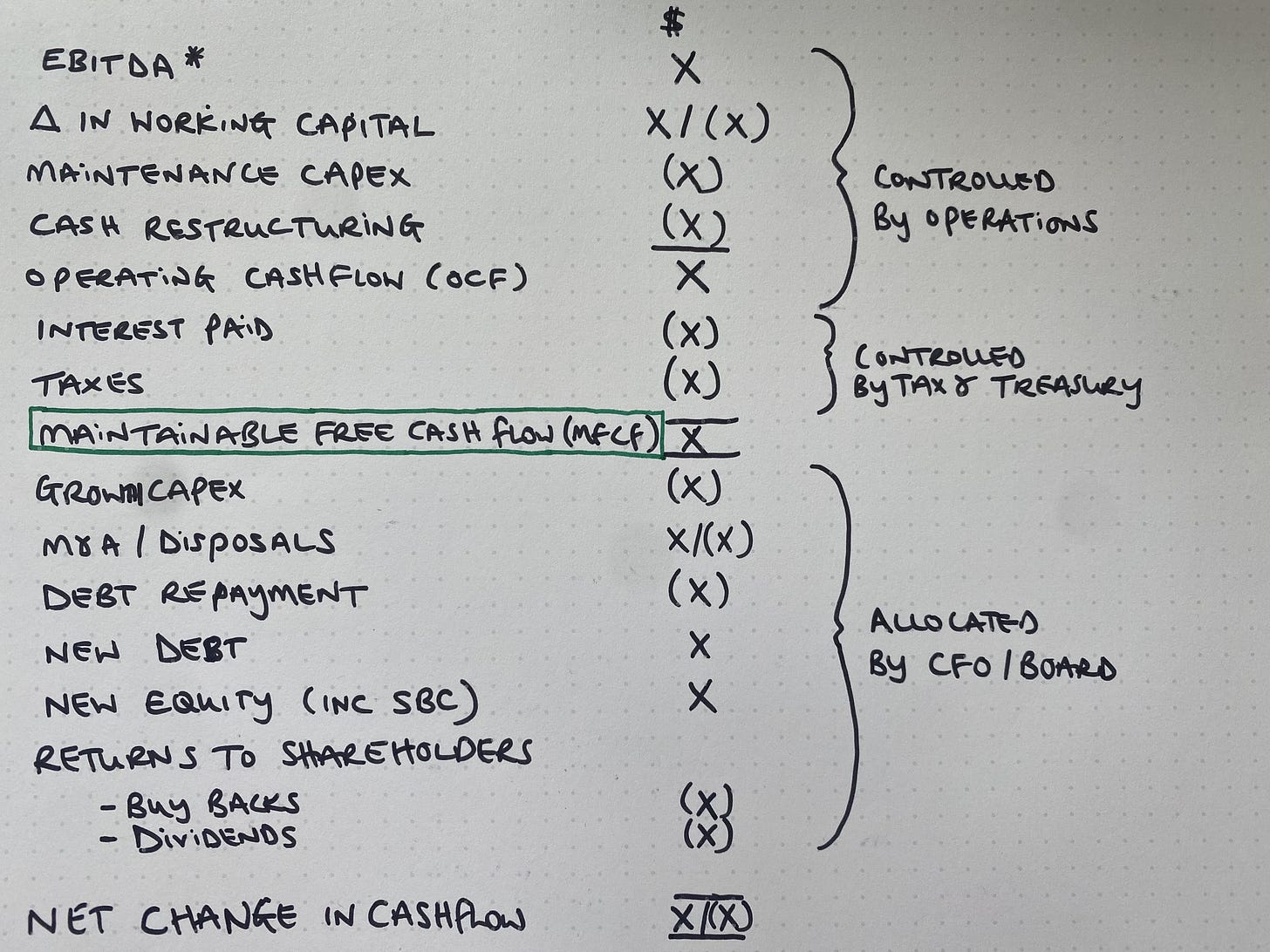

The following calculation of maintainable free cash flow is a great visualization of the distinction between:

Cash Generation: cash flow line items that are attributable to operations

Capital Allocation: cash flow line items that are attributable to the board/CEO/CFO

The major change between Maintainable FCF and just the regular FCF is moving Growth Capex below the Maintainable FCF line. However, sometimes it's difficult to distinguish between growth capex and maintenance capex for software businesses. But making that distinction is important because you need to know how much cash flow the steady-state business generates.

Many entrepreneurs focus solely on 1 (Cash Generation) and overlook the critical importance of 2 (Capital Allocation). It's the classic "working in your business" vs "working on your business" problem.

Atlasview’s Approach:

When Atlasview Equity acquires a business, we spend the first year or so making improvements to 1 (Cash Generation). Implementing best practices for sales, marketing, working capital/cash, talent/offshore resources, etc.

Once that's complete our focus shifts to making decisions around 2 (Capital Allocation). Depending on what we learned about the business/industry during that first year in operations, we make decisions accordingly.

Our general framework for capital allocation is summarized as follows:

If you're a software operator and are interested in learning more about Atlasview's strategy for value creation, reply to this thread and we’ll get back to you within a few business days!

Our Favorite Reads

Atlasview’s Investment Criteria

We look for the following characteristics in our partner companies:

Industry: Software and tech-enabled businesses

Business Profile: Sticky B2B customer base

Size: Minimum $1m EBITDA or $5m ARR

Geography: The US & Canada preferred

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to reach out and get in touch with us!

Atlasview Insights <> Deal Bridge Media

This newsletter was powered by the team at Deal Bridge Media. Deal Bridge builds newsletters for M&A firms to help them generate more inbound deal flow.

Does your investment firm want to start a newsletter? Get in touch with Deal Bridge today!

About Us

Atlasview Equity is a private equity firm specializing in software and tech-enabled businesses. We combine patient capital with proven operational strategies to deliver predictable results for our stakeholders.