Happy Wednesday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Interested in Leading a PE-Backed Company?

Have An Opportunity For Us?

4 Non-Financial Reasons Owners Sell Their Business

Why Most QofEs Miss 50% of the Work

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Interested in Leading a PE-Backed Company?

Atlasview Equity Partners is on the lookout for talented CEOs and experienced operators to drive growth at our portfolio companies. We are seeking professionals with an impressive track record and an abundance of ambition. If you're eager to leverage your leadership skills, build a lower-mid market business into a market leader, and generate significant personal wealth, we want to hear from you.

Join Atlasview’s CEO/Operator Network

By joining our exclusive list of top-tier candidates, you'll be the first to know about exciting CEO and operator opportunities within our expanding portfolio. We currently have an exciting pipeline of new opportunities, so join our network ASAP.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm that acquires and builds B2B businesses in the lower middle market. For platform investments, we look for:

Business Model: vertical software, business services, specialty distributors

Business Size: minimum $1m EBITDA or $10m revenue

Business Profile: sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We’re seeking add-ons in the library, archive, legal, and government niches for our portco Soutron Global and HVAC distributors for our portco PureFilters.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

4 Non-Financial Reasons Owners Sell

As a buyer of owner-operator businesses, Atlasview has encountered all kinds of reasons why owners look to sell their businesses. Sometimes it’s financially driven - business owners are looking for a well-deserved payday and want to diversify their net worth. But sometimes, the reason for the sale has little to do with money.

Here are 4 common non-financial reasons owners look to sell their perfectly healthy business:

#1 - Retirement – children don’t want the business, there is no internal succession plan, and eventually the owner wants to stop working full-time to enjoy retirement with their family. Finding a replacement CEO is no easy task and this is something Atlasview can certainly spearhead. We tap into our extensive CEO/Operator Network and utilize our bench of experienced recruiters to find the perfect fit, both strategically and culturally, to ensure a smooth transition.

#2 - Partner Dispute - the business has more than one owner and the owners have differences in strategy, preferences, or work style. A dispute could catalyze the sale of all or some of the business. Atlasview has experience with situations like this and can come up with a creative structure to ensure all parties win.

#3 - Burnout – running a small business is no walk in the park. Many owners, who often wear multiple hats, run out of energy to continue dealing with employees, customers, and or general operations. Atlasview has a proven playbook to streamline operations post-acquisition. With help from our operating partners, we look to alleviate bottlenecks the business may be experiencing.

#4 - Tragedy – adverse health/marital/family situations could catalyze a sale, as the owner needs the liquidity (and free time) for personal reasons. In sensitive situations like this, Atlasview is more than happy to execute a discreet and fully confidential transaction. We have deep respect for business owners who have built a successful business and vow to protect their legacy as the new owners.

None of these reasons have much to do with money or the owner’s confidence in the business. It’s always an important distinction for us, to separate between the quality of the business and the owner’s reason for selling. If you’d like to start the conversation about selling your business, always feel free to reach out to us.

Why Most QofEs Miss 50% of the Work

This is a mandatory watch for all acquirers of small and medium-sized businesses. Elliott Holland of Guardian Due Diligence explains some major pitfalls of standard Quality of Earnings (QofE) reports and common red flags to look out for. We found this video to be very insightful, and Elliott does a fantastic job making the topic of QofE entertaining and humourous!

Check it out below:

In Case You Missed It

Here are some of our previous popular issues:

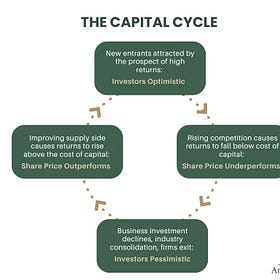

Capital Cycle Theory

Popularized by Marathon Asset Management via the book Capital Returns, Capital Cycle Theory dictates that investor returns are largely impacted by the capital flowing in or out of industries. Being on the right side of capital flows can generate sizeable returns.

Atlasview Selected in Axial’s 2024 Top 50 Technology Investors

We are honoured that Atlasview Equity Partners was selected in Axial’s Top 50 Lower Middle Market Technology Investors for 2024. For the full list, check out the full article.

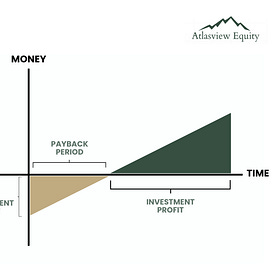

Reinvesting Capital in Organic Growth

At Atlasview we generally prefer reinvesting free cash flow/capital into inorganic growth (M&A, add-on acquisitions), as outlined in our upside case. But sometimes we uncover opportunities for substantial reinvestment into organic growth as well. This article is an overview of our approach to evaluating organic reinvestment opportunities.

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Atlasview

Atlasview Equity Partners is a private equity firm that acquires and builds B2B businesses in the lower middle market. We combine patient capital with proven strategies to deliver predictable results for our stakeholders.