A few years ago I read Ed Thorp’s book and became fascinated with card counting in blackjack. Thorp was a mathematics professor & professional investor, who figured out how to count cards and beat blackjack dealers, forever changing the rules of the game and the gambling industry.

Though I was 20 years too late (casinos have protocols in place now), card counting taught me some interesting lessons. One in particular regarding edge and bet sizing. Here’s the lesson and how it applies to private equity.

Card Counting in Blackjack

The basic concept is whether you have an edge over the dealer (or the dealer has an edge over you) depends on the type of cards that are remaining in the deck. The more high cards (10, Jack, Queen, King, Ace) remaining in the deck, the larger your edge. The more low cards (2, 3, 4, 5, 6) remaining in the deck, the larger the dealer’s edge.

You keep a running count which starts at 0 with a deck shuffle. The higher your count, the larger your edge over the dealer (and vice versa). Each low card that’s dealt increases your count by 1 because that means one less low card remaining in the deck, increasing your edge. Each high card that’s dealt, same logic in reverse, it decreases your count by 1. Keep in mind, it can take hours or even days of continuous play to achieve a high running count and it may only last for a few minutes.

Here’s the lesson: when you do manage to achieve a large edge (high count), you increase your bet size significantly. That’s how you make money in blackjack.

Benefits Of Increasing Bet Size

This lesson in increasing your bet size when you have an edge applies to private equity as well. When I refer to “increasing your bet size” here, I mean investing more money into an existing portfolio company.

So why would you do this? Let’s take a look at some of the reasons.

Having an edge

In order to generate above-average returns in investing over the long run, you need an edge. One of the simplest ways to do this is to be an owner of a specific business. Time increases the knowledge of the asset you own, giving you an edge over outsiders. Having this knowledge/edge allows you to determine if increasing your stake/bet is the best return on investment (versus pursuing a new opportunity).

Knowing the “running count” of the business you’re invested in is an advantageous position to profitably increase your bet size and returns.

Good opportunities are rare

Good businesses are rare. With the advent of technology, disruptions happen frequently across multiple industries. If you’ve managed to invest in a clear winner, just understand that it’s a rare feat. Even the smartest investors are often wrong with their picks. Good businesses tend to continue to compound and get even better over time. This makes a compelling case for increasing your bet size on high-performing businesses you already own.

Similarly in blackjack, achieving a high count at a table can take a long time. Since achieving a high count is relatively rare, when you do manage to obtain it, you’ll want to take advantage.

Easier capital deployment

Seeking new opportunities to invest in requires time, effort, and resources. Not to mention, the level of uncertainty and risk in investing in something that’s completely new.

But with assets you already own, you will have already done the research, analysis and kept up-to-date with the progress. Not to mention, you have access to expertise within your portfolio companies’ management teams. This makes it far less effort to allocate capital to your existing positions over seeking net new opportunities.

How Atlasview Increases Its Bet Size

Atlasview pursues a buy-and-build strategy for our portfolio companies. This means we make an initial investment into a platform, and then deploy further capital to acquire smaller add-on acquisitions to grow the business. This is a near-perfect analogy to increasing your bet size in blackjack. But how do we know when the “running count” is high?

When we assess a new acquisition opportunity, it’s hard to determine the exact reinvestment potential of the business. The due diligence timeframe is fairly limited and, as an outsider, we have information asymmetry working against us.

For this reason, we underwrite every new platform with the assumption that there will not be opportunities to increase our bet size in the business, post our initial investment. This means the initial platform must be able to deliver attractive returns on its own.

When we complete an initial platform investment, just like in blackjack, we start the running count at 0. We spend time with management to learn every aspect of the business, gain a better understanding of the industry, and analyze potential opportunities. During this period we also implement best practices for organic growth to maximize cash flow.

After about a year of keeping a “running count” on the business, we will know whether it’s high or low. With this informational edge, we can decide whether it makes sense to increase our bet size or not.

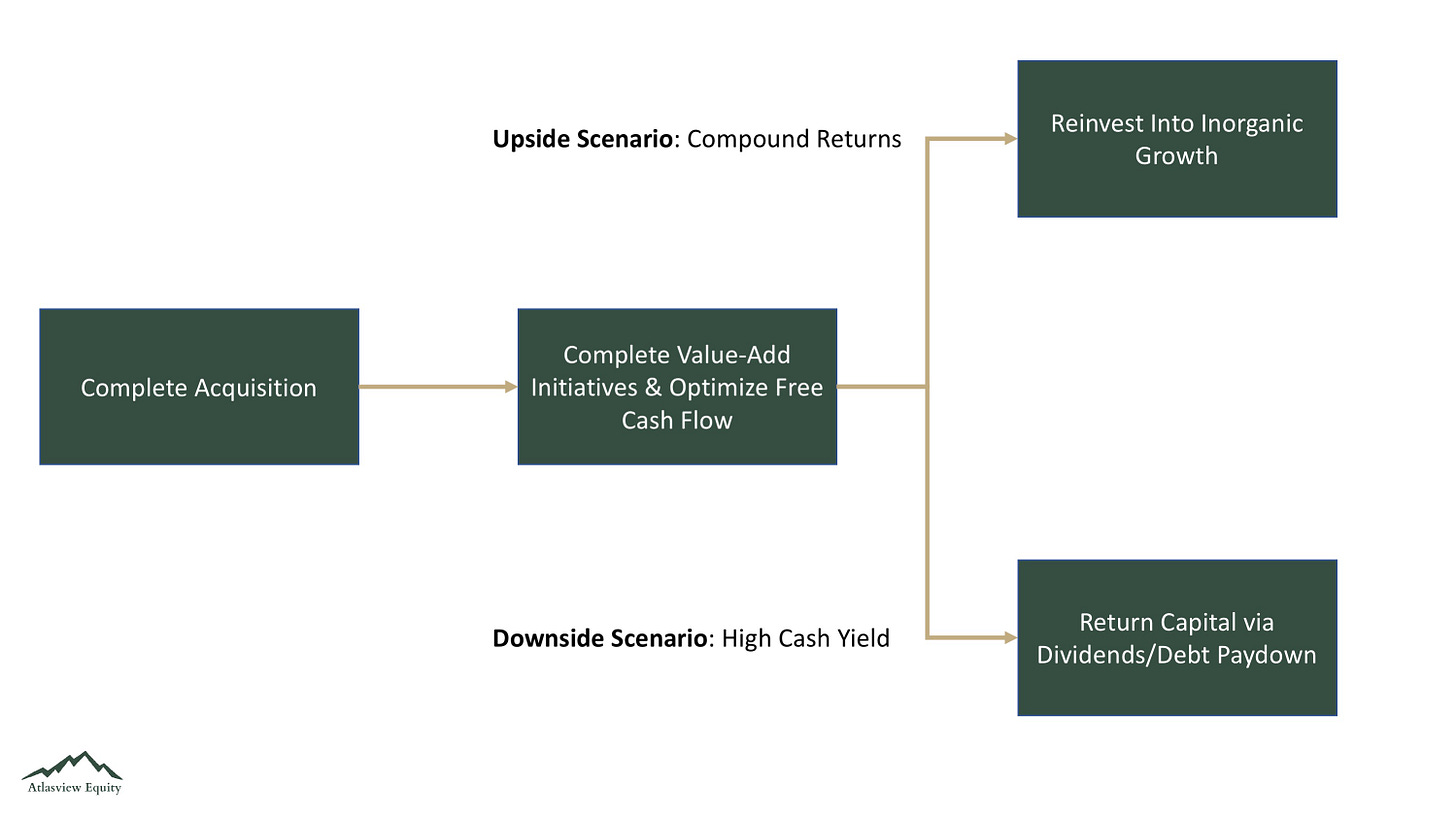

Increasing our bet size would mean deploying more capital (either debt or equity) into the business to acquire add-ons. In the upside scenario, we are able to compound returns and grow the business to new levels through add-on acquisitions. But if we determine that increasing bet size wouldn’t make sense, we would look to return capital via dividends and debt paydown. This downside scenario is still a great option given that the initial platform is able to generate attractive returns on its own.

Final Thoughts

Blackjack taught me an important lesson in increasing your bet size when you know you have an edge.

At Atlasview Equity, we use similar logic and approach to increasing investment size in our portfolio companies. If you’d like to learn more about our process, feel free to reach out.