Happy Wednesday folks!

Thanks for joining us for another edition of Atlasview Insights. We use this newsletter to share our strategies, philosophies, experiences, and lessons we’ve learned along the way. Small bite-sized insights for business owners, dealmakers, and investors.

In this newsletter, we cover:

Our Investment Criteria

Margin of Safety - Managing The Unknown Unkown

ICYMI - Popular Previous Issues

Our Deal Process

Make sure to subscribe and if you enjoy the content, we'd appreciate you sharing it with your network.

Have An Opportunity For Us?

Before we jump into this issue, a quick reminder, Atlasview Equity Partners is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. For our platform investments, we look for:

Business Model: Software, services, other asset-light

Business Size: Minimum $2m EBITDA or $10m revenue

Business Profile: Sticky B2B customer base

Business HQ: US & Canada

For add-on acquisitions for our portfolio companies, we have no size/geography criteria. We are actively looking for add-ons in the library, legal, and government niches.

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

Margin of Safety - Managing the Unknown Unkown

At Atlasview, we believe true risk means the “unknown unknown”. After you’ve thought about all the potential negative or adverse things that could happen to a business … risk is what’s remaining. It’s the events or elements that you didn’t consider simply because you couldn’t forecast or predict them in advance.

So if you can’t predict or forecast an unknown unknown risk in advance, how do you protect against it?

Margin of Safety.

It’s a concept that was popularized by Benjamin Graham. To quote the father of value investing:

The function of the margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future.

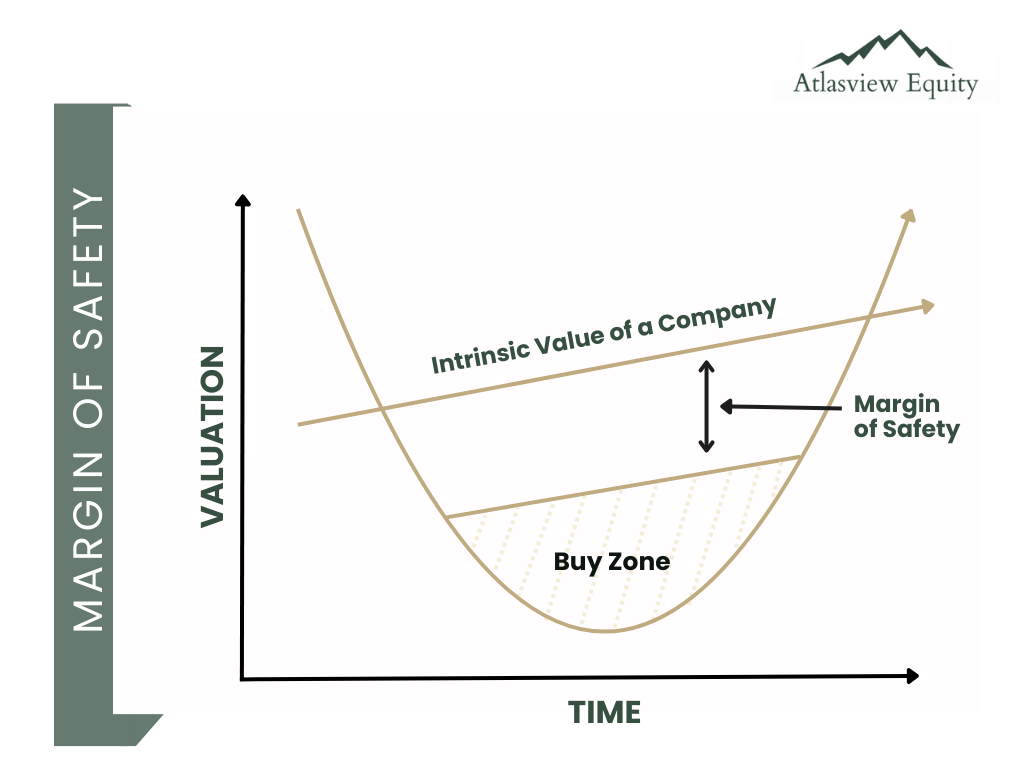

The traditional margin of safety principle refers to a company’s valuation and its intrinsic value. The idea is to purchase a company at a price that is well below the intrinsic valuation. This is to compensate for errors in your calculations of the company’s intrinsic value, or perhaps some unknown risks you didn’t consider (and therefore didn’t price in). The margin of safety allows for a cushion for the company’s intrinsic valuation to fall before you’re in the red.

We apply this margin of safety principle to not just purchase price, but also business operations as well. A fully optimized system is a fragile one. We prefer to leave some slack or cushion to withstand adversity. Some areas include:

Headcount: having additional headcount in critical departments, and not running teams too skinny.

Leverage: moderate use of debt, instead of maximizing the last dollar

Cash on hand: keeping extra cash on the balance sheet

The world is inherently unpredictable, so there is no shortage of unknown unknown risks. Employing a margin of safety will allow you to withstand adversity, and protect your downside.

In Case You Missed It

Here are some of our previous popular issues:

The Lindy Effect

At Atlasview, we are big believers in The Lindy Effect. Popularized by author, Nassim Taleb, it states that the longer something has been around, the longer it will likely continue to be around. We consider this when looking at businesses to acquire or invest in. Businesses with longevity often come with a high degree of resilience.

Our Approach To Upside vs Downside

At Atlasview, for each deal we look at, we map out what the probable downside and upside scenarios look like. We want there to be an element of positive asymmetry between the upside case and the downside case.

Moats: Prioritizing Defensibility in Investments

A moat is an element of a business that protects its core operations from competitors and new entrants. Moats enable businesses to generate an attractive return on their invested capital. Moats come in various flavours and strengths, but all good businesses have at least one solid moat.

Our Process at Atlasview

We pride ourselves on having a simple and transparent process. Our streamlined process enables us to move quickly to get you answers fast.

Step 1: Contact Us

Step 2: Execute NDA & Schedule Call

Step 3: Receive Offer & High-Level Terms

Step 4: Execute LOI & Complete DD

Step 5: Close Deal & Receive The Cash

Step 6: The Fun Part Begins!

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to contact us!

About Us

Atlasview Equity Partners is a private equity firm acquiring and investing in software, services, and other asset-light B2B businesses. We combine patient capital with proven strategies to deliver predictable results for our stakeholders.