How To Make Cash Magically Appear In Your Business

And What To Do With That Extra Cash!

One of the most common ways we’ve seen business owners under-optimize their cash flow is by overlooking the potential of their working capital. Pulling a few levers in your business can generate cash that you didn’t even know you had. This extra cash can be reallocated to expand your business.

Let’s walk through an example.

Making Cash Magically Appear

You’ve been in business for a while now and built great relationships with both your vendors and customers. Invoices show up from your vendors with net 30-day terms but your accounting clerk pays them within 5 days. You give your customers 30 days to pay their invoices, but many of them end up paying a few weeks late. You don’t mind because they always end up paying, so on average, you collect invoice amounts within 45 days.

You keep a healthy $1.5m of cash on hand as a cushion, generate $1.5m in net profits each year, and pay it all out as dividends.

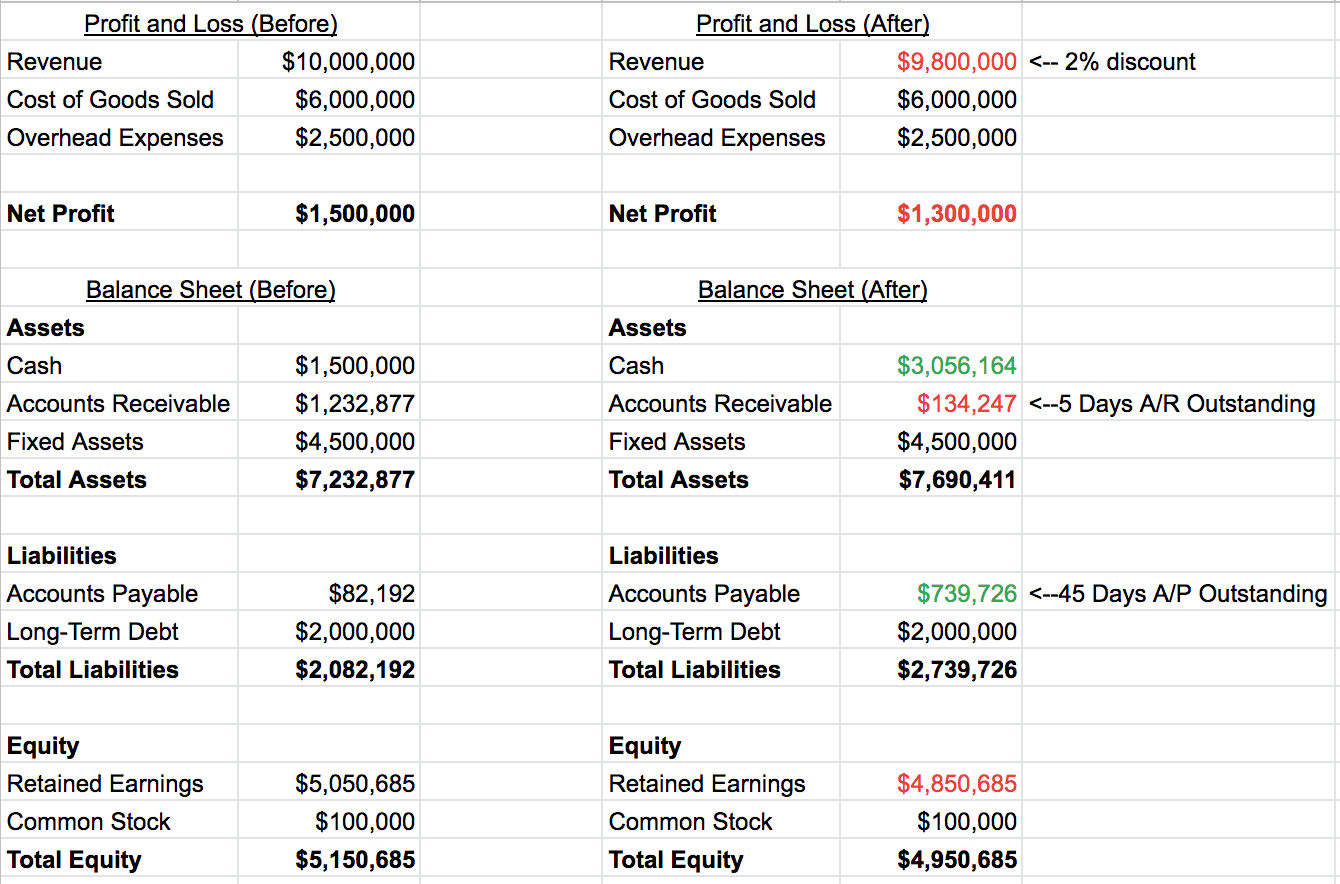

As a result, this is what your profit & loss and balance sheet look like today:

Now, let’s pull 2 levers here to maximize your cash balance: pay slower & collect faster. You call up your vendors, use the goodwill you’ve built up and negotiate an additional 15 days on invoices. You then instruct your accounting clerk to pay on the 45th day. You incentivize your customers with a 2% discount if they pay their invoice within 5 days, and they all take you up on the offer.

Here’s what your financials look like after implementing these changes:

By collecting faster and paying slower, you’ve sacrificed $200k in net profit, but increased your cash balance by $1.75m (net cash increase of $1.55m). Most business owners would balk at the idea of sacrificing profit, but that’s because they’re underestimating the power of that extra cash. As long as your business doesn’t shrink, that increased level of cash float will always exist. And if your business happens to grow, that cash float should expand.

This is just one of the many financial optimization tactics in Atlasview’s value creating playbook. There are so many more levers that you can pull to optimize working capital and increase your cash float. If you’re interested in learning what they are and how to apply them to your business, please don’t hesitate to reach out .

Allocating The Extra Cash

Now we need to allocate that extra $1.55m cash. You could pay this out as a dividend, but that’s only a one-time bump. You are far more ambitious and want to create lasting value in your business. Let’s look at the 3 options you have.

Option 1 - Pay Down Debt

You could pay down $1.55m of the $2m debt you have on your balance sheet. You’d save money on interest you’re currently paying on your debt. If you were paying a 15% interest rate, paying down debt means you save $232.5k per year in interest. This is a net savings of $32.5k per year, since you sacrificed $200k in net profits to generate the extra cash.

It’s not a substantial amount of savings, so let’s see what else you could do with the cash.

Option 2 - Organic Growth

You could reinvest the extra $1.55m back into your business. Undertake initiatives like hiring more salespeople, increasing advertising spend, investing in R&D projects, and purchasing more equipment. All with the aim of increasing revenue, and ultimately increasing net profit by at least $200k.

But in the event you’ve already implemented and exhausted all potential organic growth initiatives, there’s one more option…

Option 3 - Inorganic Growth

You could use the extra $1.55m cash to acquire a competing or complementary business to yours. Or perhaps a supplier or customer. Depending on your industry, this could unlock significant value.

Acquiring businesses does require expertise in M&A. Part of Atlasview’s value creation playbook is accretive acquisitions. We work closely with our portfolio companies to source, evaluate and structure acquisitions. If you believe your business could grow through acquisitions and want to work with M&A-experienced partners, contact us, we’d love to chat!

Value Creation

So let’s say you went with option 3. You sourced a complementary business generating $900k in profit, and the owner wants $4.5m for it (5x profits). You use the $1.55m cash as the equity, and borrow the remaining $2.95m to close the deal. Congratulations, you are now the owner of a $2.2m net profit business! ($1.3m existing business + $0.9m new business)!

Keeping the 5x profit multiple, your business went from being worth $7.5m ($1.5m profit x 5) to $11m ($2.2m x 5). And this doesn’t include any cost synergies or multiple expansion (larger businesses are worth more). And the best part? You didn’t require any additional equity dilution.

That’s the power of optimizing your working capital. Pulling a few levers made cash magically appear and ultimately created $3.5m in value. Now imagine rinsing and repeating what you just did for the newly acquired business. The sky’s the limit!

Final Thoughts

The main lesson here is to challenge yourself as a business owner by asking if cash is currently optimized and allocated to the best use. In this example, by reallocating cash that was parked in the working capital of your business, you’ve created significant value. That’s the power of combining operating prowess and shrewd capital allocation.

As both an operator of businesses and an allocator of capital, Atlasview is constantly assessing portfolio company cash and where it’s being parked. We hope this post inspires you to do the same. If you have any questions about working capital for your business, always feel free to reach out to us.