What's Wrong With IRR?

Atlasview Insights -- bite-sized weekly insights that are relevant to all business owners, dealmakers, and investors.

Happy Wednesday fellow dealmakers and software enthusiasts! Thanks for joining us for another week of Atlasview Insights.

If you are a new reader, every Wednesday our team at Atlasview Equity shares bite-sized insights that are relevant to small business owners, dealmakers, and investors.

This week we’re looking at:

Why IRR is often just a marketing metric

The value of a contribution margin grid

Jay Vas’ recent podcast appearance

Insights from fellow LMM investors, Thomas Ince, and Ben Tiggelaar

IRR Shenanigans

Our team often jokes that IRR is just a “marketing metric” and MOIC is a “reality metric”. But the joke has some truth to it. Just look at the following table which outlines 3 different scenarios where $1m is invested, and a 19% IRR (internal rate of return) is generated:

Despite the profits from each of the above scenarios ranging from $474 to $1,383,288, all 3 scenarios generate a 19% IRR.

So What’s Wrong With IRR?

The IRR formula is time-based and assumes money is reinvested at the same rates throughout the hold period. It incentivizes managers to return capital and profits as fast as possible. In some scenarios, this might make sense, but in others, it might not. Investments that return capital fast (by way of realized exit) have two main disadvantages:

You need to find somewhere else to reinvest the cash

You need to pay taxes and transaction costs more frequently

Whether these disadvantages are big issues really depends on the investor base.

Our Approach to Underwriting

At Atlasview Equity, we prefer focusing on MOIC (multiple on invested capital) as the main investment return metric when underwriting deals. We want to generate an acceptable level of absolute profits for our investors. Ideally, we want to find businesses that have reinvestment opportunities so the capital we invest can compound over our holding period.

If you’re an accredited investor or qualified purchaser and interested in learning more about Atlasview’s investment opportunities, please inquire here:

We work closely with family offices, high-net-worth individuals, and institutions to make control investments in profitable software and tech-enabled businesses.

Preferred Investment Criteria

We look for the following characteristics in our partner companies:

Industry: Software and tech-enabled businesses

Business Profile: Sticky B2B customer base

Size: Minimum $1m EBITDA or $5m ARR

Geography: The US & Canada preferred

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to reach out and get in touch with us!

Favorite Business Read from 2022

Pick – Capital Allocation by Jacob McDonough

This book details the early days of Berkshire Hathaway. Warren Buffett acquired the business in 1965 and started making drastic changes. It’s an in-depth look at all the early critical business decisions Buffett made to lay the groundwork for Berkshire to transform it into the $704bn conglomerate it is today.

Why did we like It?

This book was very well researched and the author eloquently weaves words and numbers together. There were a lot of interesting tidbits about Berkshire & Buffett that we didn’t know. For example, Buffett used ample leverage in the early days to get deals done (but today, he often speaks against using leverage). Overall, this is a must-read for anyone responsible for allocating capital within a business. This book will show you how Buffett ruthlessly allocated capital to the best available options to build the empire he has today.

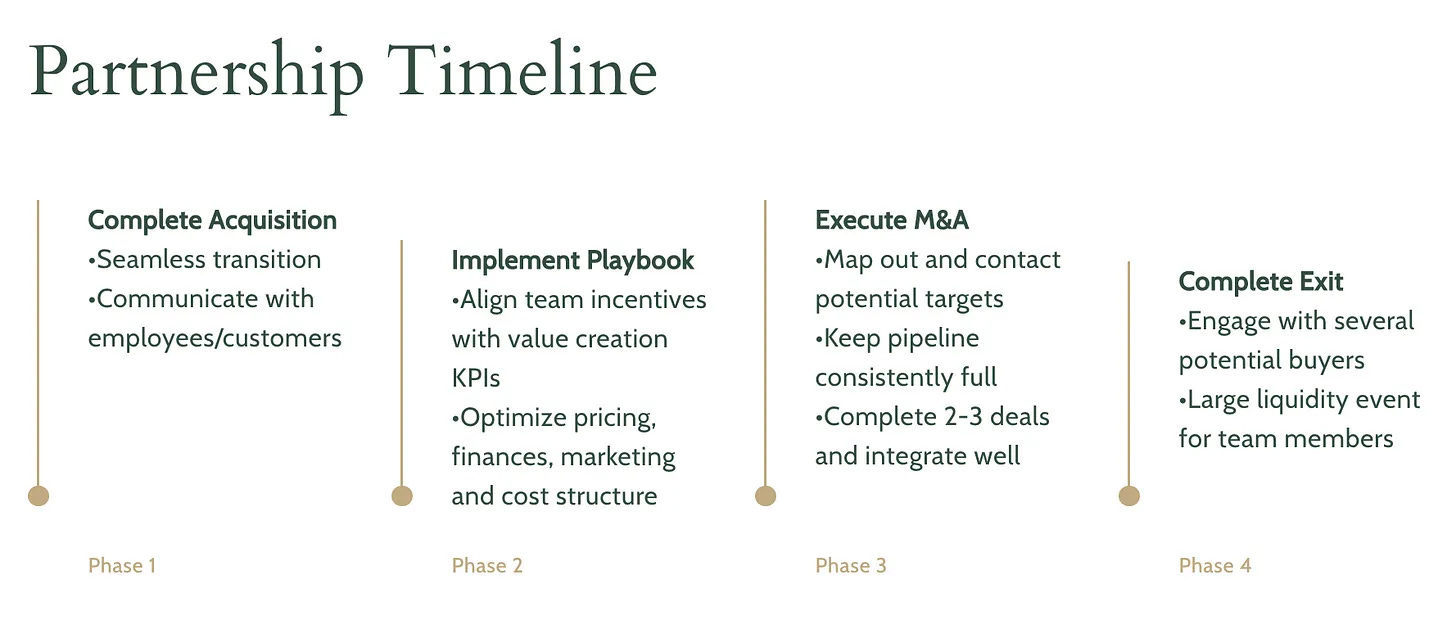

The Atlasview Playbook

Last week, Jay had the chance to sit down with Aram Ehamparam, to share a behind-the-scenes look at Atlasview’s playbook (strategy, firm origins, value-add). It’s a great listen for anyone wanting to learn more about Atlasview and how we approach lower-middle-market software/technology acquisitions.

Deal Maker Perspectives

Operator Perspectives

Great financial performance is a products of 1,000 great micro decisions. All under one clear direction. That’s where the magic happens.

Atlasview Insights <> Deal Bridge Media

This newsletter was powered by the team at Deal Bridge Media. Deal Bridge builds newsletters for M&A firms to help them generate more inbound deal flow.

Does your investment firm want to start a newsletter? Get in touch with Deal Bridge today!

About Us

Atlasview Equity is a private equity firm specializing in software and tech-enabled businesses. We combine patient capital with proven operational strategies to deliver predictable results for our stakeholders.