Capital Reallocation Visualized

Atlasview Insights -- bite-sized weekly insights that are relevant to all business owners, dealmakers, and investors.

Happy Wednesday folks!

We are thrilled to have you join us for another edition packed with valuable content for small business owners, deal makers, and investors alike.

For those who may be unfamiliar with us, Atlasview Equity is a private equity firm specializing in software and tech-enabled businesses. To learn more about our experienced team and investment criteria, visit us here.

In this newsletter, we cover:

Capital Reallocation Visualized

Our Favorite Reads

Insights From Our Team

If you enjoy what you read, please be sure to subscribe and share with your colleagues.

Preferred Investment Criteria

We look for the following characteristics in our partner companies:

Industry: Software and tech-enabled businesses

Business Profile: Sticky B2B customer base

Size: Minimum $1m EBITDA or $5m ARR

Geography: The US & Canada preferred

Whether you’re a business owner interested in working with us, or an intermediary with a deal to share, always feel free to reach out and get in touch with us!

Capital Reallocation Visualized

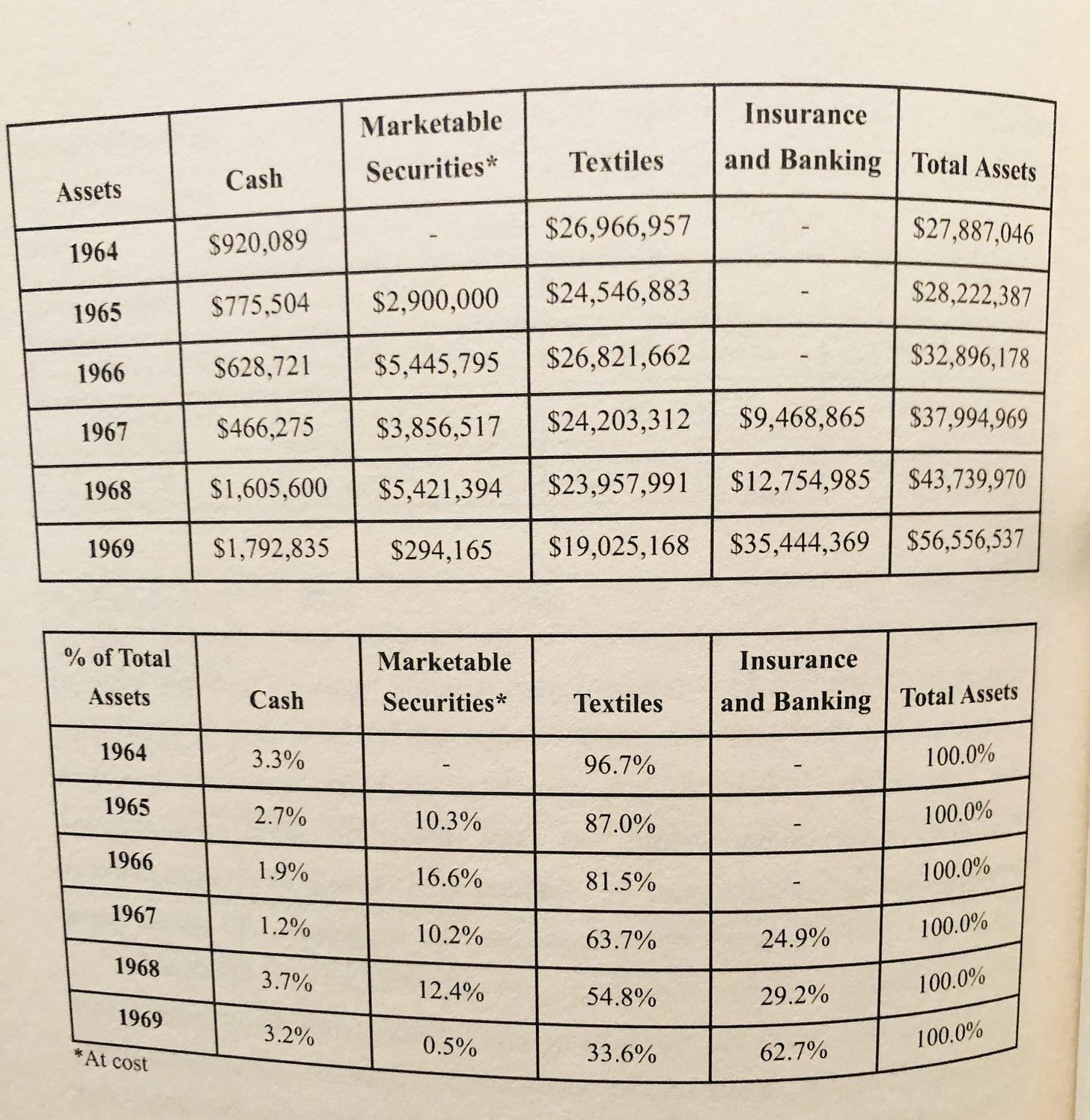

To celebrate Berkshire Hathaway’s Annual Shareholder Meeting that took place in Omaha this past weekend, we wanted to share a chart detailing how capital was (re)allocated for Berkshire Hathaway from 1964 to 1969.

This chart makes reallocating capital look very easy. The eloquent transition from textiles (low ROI) to insurance and banking (higher ROI) in a span of just 5 years.

It hides the true reality of reallocating capital though. Things like laying off staff, shutting down factories, closing vendor accounts, and canceling projects. Not to mention, the immense trust required from investors. Investors signed up to be owners of a textile manufacturer, and you’d have to communicate why shrinking that entire operation and allocating the cash to insurance/banking instead is better.

You also risk capsizing the original ship, and perhaps overestimating the strength of the new ship. None of this is easy and requires a skilled operator to execute and communicate the plan. Reallocating capital results in short-term pain, but owners and the stakeholders that remain can benefit immensely.

And it’s not just failing old textiles manufacturers where capital reallocation proved to be a wild success. Tech startups often “pivot”, meaning they change course from the original idea to something completely different. This, in a sense, is a form of capital reallocation. Lots of short-term pain and immense trust are required from investors. All parties involved signed up for the original idea/vision, and convincing everyone to pivot to something new is no easy feat. But again, if pulled off can leave owners and remaining parties all in a much better position.

As a business owner, ask yourself:

How is capital and resources currently allocated in your business(es)?

Is there a better use of capital, and if so, is it worth reallocating?

If you’re an owner interested in working with Atlasview or an intermediary with a deal to share — feel free to reach out and contact us. We will respond within 24 hours, and we can have an offer on the table within 7 days.

We are happy to pay referral fees for any deal referred and successfully closed.

Our Favorite Reads

Atlasview Insights <> Deal Bridge Media

This newsletter was powered by the team at Deal Bridge Media. Deal Bridge builds newsletters for M&A firms to help them generate more inbound deal flow.

Does your investment firm want to start a newsletter? Get in touch with Deal Bridge today!

Insights from our Team

Operations

M&A

About Us

Atlasview Equity is a private equity firm specializing in software and tech-enabled businesses. We combine patient capital with proven operational strategies to deliver predictable results for our stakeholders.